Getting rich slowly notes from TE&E Time at RSB

From a discussion led by Rob Lanfear ‘How to get rich slowly: a bunch of things about money I wish someone had told me when I was a grad student’

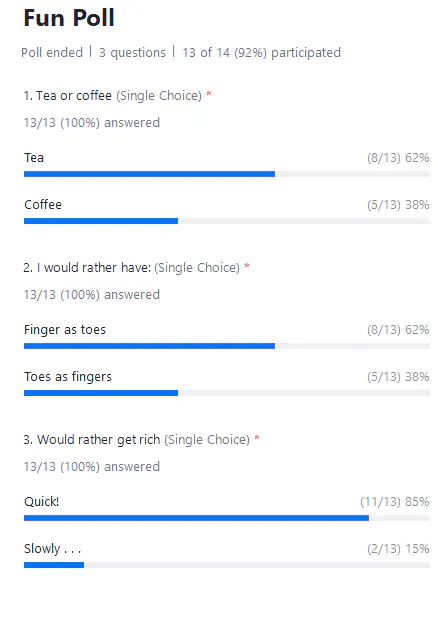

our silly poll for the day

our silly poll for the day

2021-10-06 Wednesday

We started our TE&E Time talk today with a silly poll…

Our topic of discussion today is “How to get rich slowly: a bunch of things about money I wish someone had told me when I was a grad student.” Led by Rob Lanfear

These are the notes I took quickly as the discussion went along, they might not be super accurate and detailed! This is not a fiancial guide and I’m not a professional financial advisor. These are simply quick notes I wrote down for myself.

Books recommendations to get started:

- *The Barefoot Investor by Scott Pape

- Future Babble by Dan Gardner (explains with data how it’s unlikely you’ll beat index funds)

- *The Little Book of Common Sense investing - John Bogle (the founder of Vanguard Group Inc.)

*ANU staff/students can read these books for free online through the ANU Library

Superannuation

- Treat money you invested as deferred income. This means you don’t touch it until you retire. When you retire you don’t have income (or much less income) so you pay less tax.

- Investing in SUPER, you don’t pay any tax on capital gain.

- Inside super you can’t withdraw money as easily

How to start saving money

- Use less money, keep track of spending habits

- Bank app or personal finance app like Pocketbook

General ruls for whether you should invest your money

What to expect from investing

- Compound interest over long time. Say if you start with $1000 and the annual return on investment rate is 10%, you’ll end up with $2593.74 in 10 years.

How to start investing outside Super:

- Using stock brokerage or trading apps

Votatility and diversification

- There are risks associated with investing markets can crash any time

ETFs vs mutual funds

- ETF are index funds that you can buy/sell without going through fund managers.

- Mutual funds is a pool of money that someone professionally trades for you, often fees associated with this.

Type of investing

- Investing in individual stocks

- Dollar cost averaging

- Stocks, bonds, cash

- Cryptocurrency (contentious issue)

If you’re a low income earner (PhD students should qualify), the Aus government has a co-contribution scheme where they’ll pay up to max $500 into your super if you do a voluntary contribution of up to $1000 https://www.ato.gov.au/Individuals/Super/In-detail/Growing-your-super/Low-income-super-tax-offset/